China’s dominance in global mining and refining of rare earth elements (REEs), which are used in renewable energy technology, seems likely to continue for the next 15 years at least, but the country’s current stranglehold on the market is loosening, a new report says.

According to the S&P Global Market Intelligence report, “Rare Earths: A Sector Poised for Policy-Driven Change,” released in October, the past few years have seen intensified global interest in developing alternative sources for REEs to reduce dependency on China.

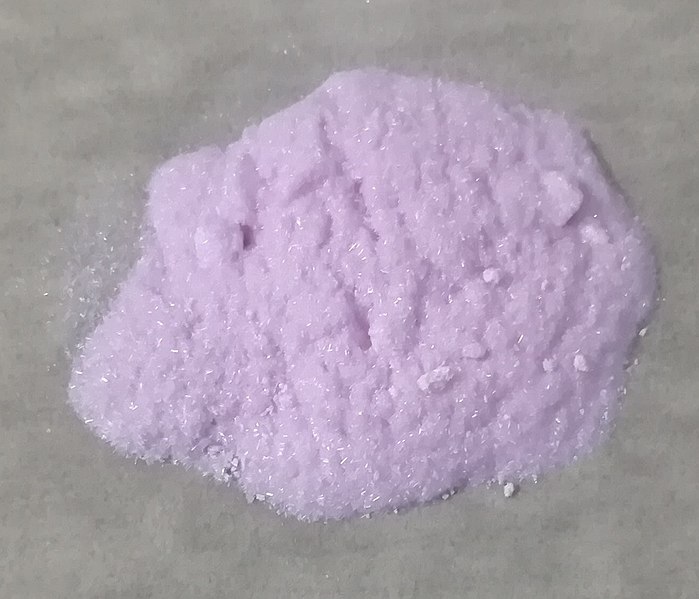

There are 17 rare earth elements, according to the U.S. Department of Energy. Though not everyone may have heard of these elements—with names like gadolinium, praseodymium, cerium, samarium, lanthanum, and neodymium—they are relatively abundant in the earth’s crust. They are called “rare” because they are rarely found in concentrations that are big enough to facilitate easy mining, S&P says.

REEs are essential in industry, according to the U.S. Geological Survey, “used as components in high technology devices, including smart phones, digital cameras, computer hard disks, fluorescent and light-emitting-diode (LED) lights, flat screen televisions, computer monitors, and electronic displays. Large quantities of some REEs are used in clean energy and defense technologies.”

Rare earths have unique properties. For instance, neodymium magnets can be up to 10 times as strong as traditional magnets. The use of these magnets in electric vehicles is expected to drive the biggest growth in demand, which is predicted to increase from 7.1% of all rare earth element demand now to 23.8% by 2040, S&P says.

Spurred by China’s continued consolidation and tightened controls, the U.S., EU and other countries are seeking to mitigate potential supply risks. However, according to S&P analysis, China’s powerful position is unlikely to disappear soon.

Citing projections based on International Energy Agency (IEA) data, S&P’s analysis suggests that even by 2040, China is expected to maintain a market share exceeding 50% in mining and 70% in refining rare earths.

China’s dominance

China’s significant influence in the rare earth market dates back to the 1980s when leader Deng Xiaoping remarked, “The Middle East has oil. China has rare earths.”

The S&P report highlights this dominance, noting that in 2023, China was responsible for 61.2% of global REE mine production, followed by Myanmar with 14.9%, the U.S. with 8.8%, and Australia with 6.9%.

Refining, an essential step in processing rare earths for high-tech applications, is even more concentrated: China commands a staggering 92.1% share, while Malaysia, the next largest refiner, holds just 5.2%, the report says.

Yet, the landscape is shifting. S&P report projects that by 2030, China’s share of mined and refined rare earths will drop to 53.7% and 76.5%, respectively. Australia is expected to make a significant leap in mining, moving from its current fourth position into second place, taking an 18.2% share by 2030.

In refining, Malaysia is forecasted to grow its share to 12.3% by 2023, solidifying its position as the second-largest refining country, with Australia joining the ranks at 3.5% by this time, the report says.

China’s regulatory control of REEs

In an effort to secure control over its rare earth resources, China has implemented robust regulatory measures aimed at strengthening oversight and consolidating the sector.

S&P Global highlights China’s new regulatory framework, set in motion in June 2024, which “stipulate that equal attention will be paid to resource protection, as well as the research, development, and utilization of rare earths.” Starting Oct. 1, China’s State Council requires that rare earths be classified as state-controlled resources, overseeing their mining, processing, and trade to safeguard national interests, the report notes.

This regulatory shift reflects a larger pattern of tightening controls over critical minerals. Since late 2023, China has enforced various export restrictions, including a ban on the export of rare earth magnet production technology and machinery and requirements for export permits for materials like gallium, germanium, and certain types of graphite, S&P Global says.

According to the report, these moves reinforce China’s readiness to use critical minerals as a “political bargaining chip,” a tactic it previously employed in 2010 when it restricted rare earth exports to Japan during a territorial dispute.

Among other things the report mentions “the merger of several leading state-owned rare earth producers in December 2021 to establish China Rare Earth Group Co. Ltd., the largest producer of heavy rare earths nationally” as one of China’s effort to consolidate and manage the industry.

U.S. and EU policies to push back

In response to China’s sweeping control measures, the U.S. and EU have recently enacted and intensified initiatives to establish reliable, diversified sources of rare earth elements. The S&P report highlights key policies such as the US Inflation Reduction Act and Europe’s Critical Raw Materials Act, which designate rare earths as critical commodities. Both the US and EU have formulated specific strategies to secure domestic REE supplies.

The U.S. Department of Defense has launched a five-year investment plan focused on building a fully integrated “mine-to-magnet” supply chain within the United States. This strategy includes infrastructure for each stage of REE production—sourcing, processing, alloying, and manufacturing magnets.

Similarly, in Europe, the European Raw Materials Alliance has introduced a “Rare Earth Magnets and Motors Cluster” to drive local rare earth initiatives. In 2021, this alliance identified 14 projects intended to build an end-to-end European rare earth supply chain, projected to meet 20% of EU demand by 2030.

Growing exploration

One of the notable trends identified in the S&P report is the sharp rise in exploration budgets for rare earth elements. Data from S&P’s Corporate Exploration Strategies shows that 2023 marked the highest aggregate exploration allocation for rare earths in a decade, with a total expenditure of $140 million. While this figure nearly doubles the average annual budget over the past ten years, it remains far below the $309 million peak seen in 2012.

Australia effectively leads in exploration spending, followed by Canada and African countries, indicating a strong interest in developing new supply chains outside of China. S&P also notes that data on domestic exploration spending in China is limited due to a lack of transparency, yet it is expected that China is investing in domestic exploration to sustain and expand its production capacity.

All in all, according to S&P’s analysis, the current geopolitical climate is accelerating policy-driven changes in the rare earths sector, with supply diversification emerging as a top priority for many countries.

While China remains the dominant player in both mining and refining, its market share is gradually expected to decline as alternative sources come online and supply chains expand.

“The pace of diversification away from China is steadily gaining momentum,” S&P concludes, but it also acknowledges that China’s well-established supply chain infrastructure will likely keep it at the forefront of the industry for years to come.